Establishing A Home Business The establishment of a home business is an attractive goal and many people are successful in accomplishing just that objective. The definition of a home business is a viable business that legitimately offers a product or a service to the public that is principally operated from a home.

The type of business can be anything that local zoning laws would allow, which should be one of the first items to put to bed to see if it is legal to run a business from the home at all. Assuming that it is legal, businesses that could be called home business light would probably be more in order for this brand of venture. Home business light simply means low impact businesses such as accounting and tax, hair salons, insurance brokers, lawyers, and such. A trucking company or a taxicab company would probably not work in a neighborhood.

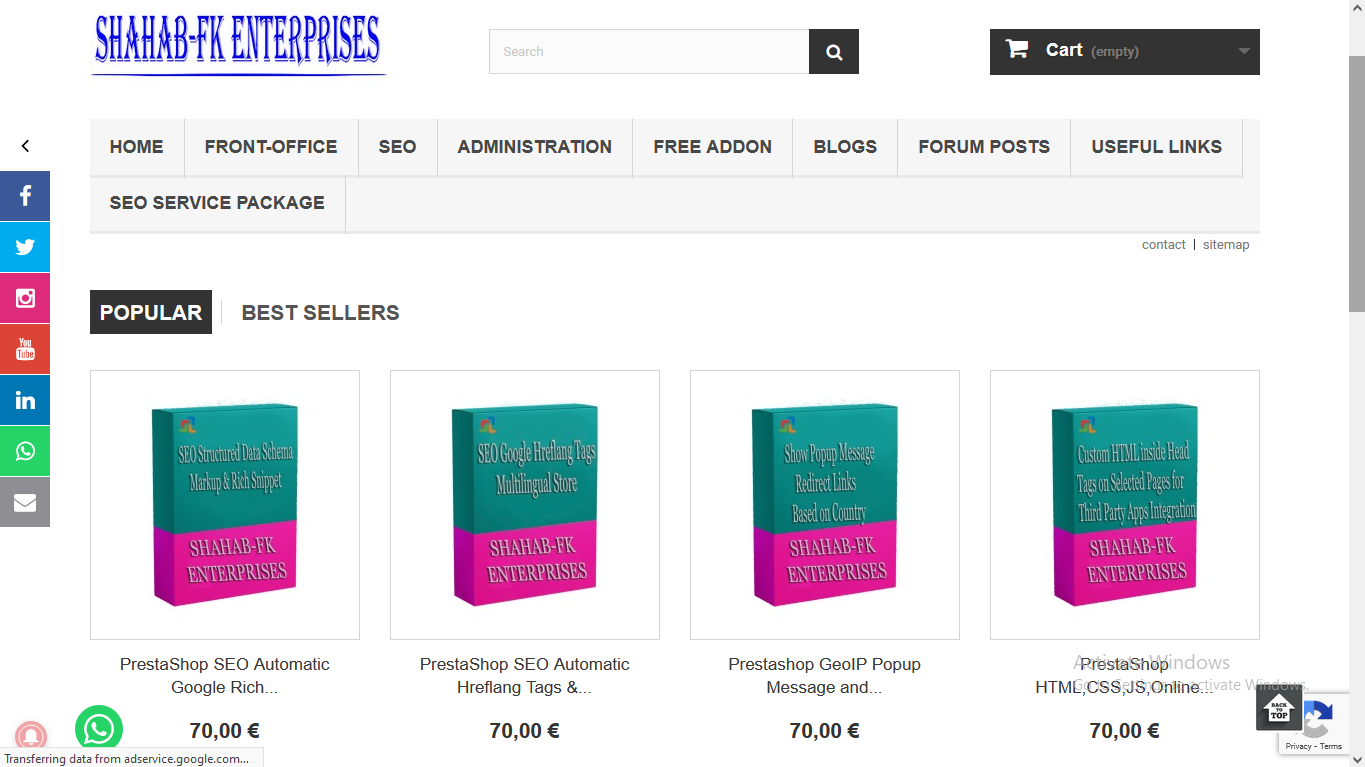

Many home business entrepreneurs operate an online business from home. Marketing products over the Internet has become a real opportunity and is profitable to many people. A company such as eBay offers people the chance to sell just about anything to anybody in the world. There is a verification system so people can judge as to the reliability of the seller and have the confidence to purchase from them.

A virtual office setup is another business that can be run from a home setting. This involves being a remote secretarial, documents production, fax and answering service. There is a great demand for this service as lawyers, service offices, insurance agents, and the like can benefit from a service such as this if it is dependable and can get the work out.

In order to become successful in a business from home a great deal of organizational ability is needed. The problem of distraction is a possibility if other members of the family don’t appreciate the need to separate household duties from business operations. This is a major problem in many cases and sinks the whole concept if it cannot be worked out.

The advantages are numerous. Not having to rent or purchase separate office or retail space is a huge cost advantage. Business space is very expensive and the ability to negate that cost from the beginning is a fabulous opportunity. Working a business from home also makes available a special Federal income tax deduction for home business use. There are other business deductions available such as supplies, mileage for business use of vehicles, meals if related to business, and other deductions.

Working from home offers being with family, which can be an advantage of not requiring childcare, if the dynamics can be arranged favorable to the running of the business. Other members of the family can be enlisted to help with the business. Children can gain a positive learning experience by participating in the operations of the business.

Once a business becomes profitable, and is working like a clock, there is no better satisfying experience and sense of control than running a business from home.